DAC7 Reporting Tool

The Platform Tax Transparency Act (PStTG), which came into force on 1 January 2023, stipulates that digital platforms must collect data on certain business transactions and transmit it to the Federal German Tax Office (BZSt) via an electronic interface for the purpose of international exchange. The first report for the 2023 calendar year must generally be submitted by 31 January 2024, but there is a non-objection rule until 31 March 2024. In addition, there is an obligation to submit a correction report immediately if an incorrect or incomplete report is known.

KMLZ’s DAC7 Reporting Tool offers a convenient solution for creating the report and submitting it to the BZSt. This applies both to the annual report and to correction reports during the year.

The cloud-based solution makes it possible to import the CSV files provided for each relevant activity, create a report from them and send it to the BZSt.

In addition, the DAC7 Reporting Tool also offers the option of automatically checking the VAT-IDs and TINs of the relevant providers.

For the purposes of plausibility checks, the operator of the digital platform subject to the reporting obligation can generate a quarterly comparison or visualise reporting amounts per provider and jurisdiction before submitting the report.

TAX-ray

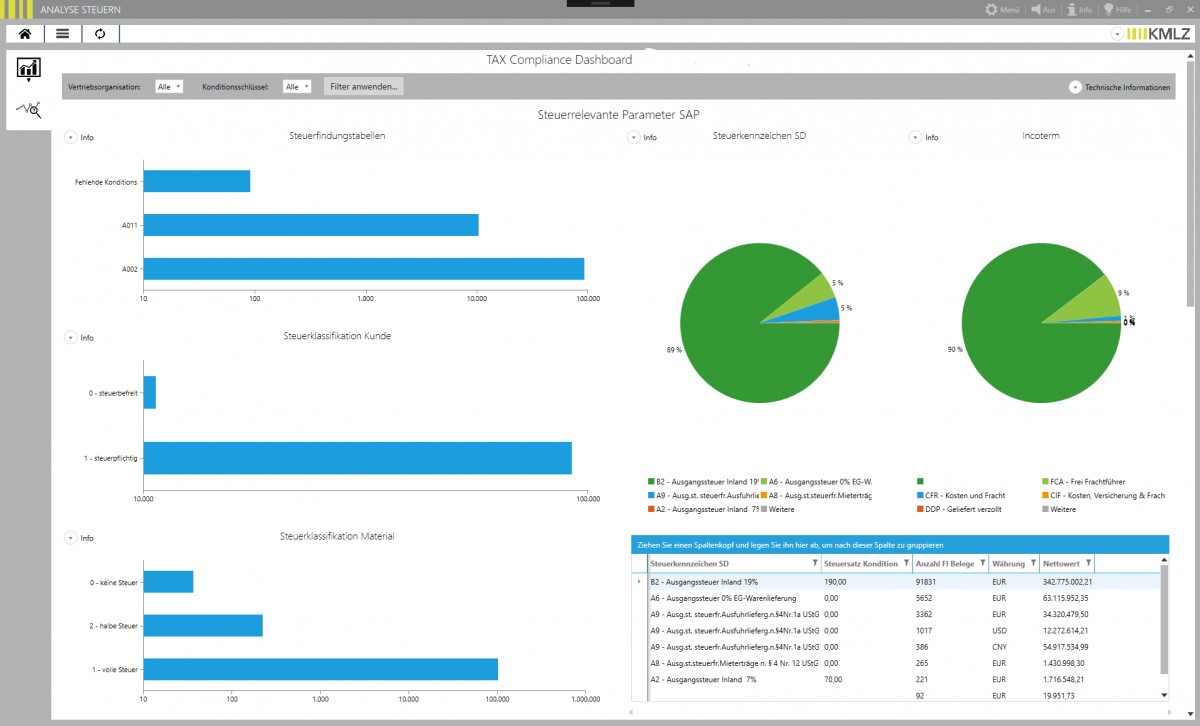

Our TAX-ray application is a data mining solution for the evaluation of tax transactions in ERP systems. The solution can be implemented and used in various BI systems (SAP BW, SAC, Power BI, etc.) and works on the basis of all common ERP systems.

Existing data in the ERP system can be systematically evaluated and the processes in tax determination can be probed. If required, details down to the item level of individual documents can be verified using our dashboard.

Our “TAX-ray (on-prem)” solution is designed as a Windows application. The data provision from the ERP system required for the analysis can be designed individually. For example, the data can be made available on an SQL server by automatically mirroring the ERP data. Alternatively, the data can be extracted by means of reports or external programmes and then be transferred to an SQL server.

TCMS Assistant

Using our TCMS Assistant, predefined audit routines can be carried out on a regular basis to fulfil and document the monitoring function within the scope of your tax compliance management. You can choose from a catalogue of standardised controls or have individual controls set up.

The TCMS Assistant is a Windows application and on-premise solution. To keep the installation effort as low as possible, the tool works, by default, with common extracts (e.g. from the Data Retention Tool) from ERP systems.

VAT-ID Verifier

Due to the Quick Fixes that came into force on 1 January 2020, the VAT identification number of the acquirer has become a requirement for the VAT exemption of intra-Community supplies. As a result, all companies should have set up processes which enable them to regularly check the validity of their customers' VAT identification numbers.

KMLZ’s VAT-ID Verifier offers a comfortable solution for verification of VAT identification numbers via various databases (VIES, German Federal Central Tax Office (BZSt), FinanzOnline Austria).

The cloud-based solution makes it possible to verify data drawn from different ERP systems and to store the query results.

The VAT-ID Verifier also offers the option of checking Swiss VAT numbers in accordance with the Swiss FTA, UK VAT numbers with the HMRC and Norwegian tax numbers in the Enhetsregisteret.

In addition, the servers of Poland (for comparison of bank accounts and local tax numbers with the so-called "white list“), the Czech Republic (for comparison of VAT identification numbers with the list of "Unreliable VAT Payer") and Slovakia (for comparison with the bank accounts registered with the tax authorities) are connected to the VAT-ID Verifier. By making use of these checks, recipients can protect themselves from being held liable for their suppliers’ VAT. Furthermore, it can be checked via the server of Italy if companies are subject to the split payment mechanism.

TAX-ray@Celonis

TAX-ray@Celonis is our application based on Celonis technology (as an on-premise solution or cloud-based) for evaluating tax transactions in ERP systems. TAX-ray@Celonis uses the numerous options of the Celonis platform. In addition to the possibilities of data and process mining, the analysis can be extended by the use of a variety of additional features.

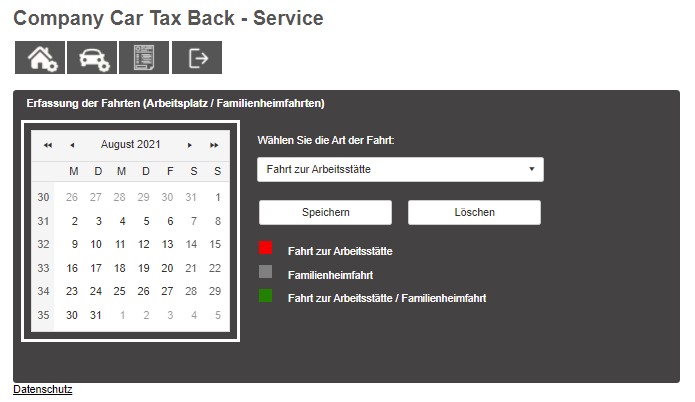

Company Car Tax Back (CCTB)

Our CCTB tool serves to realise the savings potential in the taxation of the private use of company cars for commuting between home and work location. As a rule, taxation takes place at a flat rate of 0.03% of the gross list price of the car. This applies equally to wage tax and VAT. By taxing the actual commuting between home and the work location at 0.002%, the income tax for the employee and, at the same time, the VAT for the employer can be reduced. This is where days spent in home office, on business trips and long-term illness have an impact.

Our CCTB tool is a cloud-based software-as-a-service solution. This means there is no implementation or hosting effort for IT. Payrolls also remain unchanged, so there is no effort required on the part of the HR department involved.