Implementation of an ERP system

Are you planning to implement a new ERP system? Both our tax and technical know-how allows us to act as an interface between the implementation partner, the programmers in the IT department, the individual business units (including logistics and sales) and the tax department. This makes us a reliable partner for your implementation project, as well as for setting up the tax determination logic.

Regardless of whether SAP, Oracle, Navision, Infor or another ERP system is being used, we get around the table with consultants and other IT service providers in order to define the relevant settings and necessary actions from a VAT perspective. This also applies if, for example, you are already using an SAP system and want to convert to S/4HANA. Here, too, we can support you in correctly implementing the tax-relevant settings.

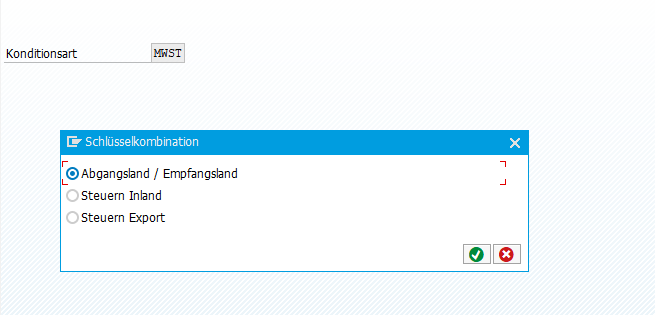

Optimisation of the tax determination

ERP systems are used to automate mass processes that occur in companies. In doing so, complex applications from different areas of the company communicate with each other. Correct settings within the system, such as a correct tax determination logic or formally correct invoicing, play an important role.

For the purpose of ensuring that your systems function properly, we put your tax determination logic through its paces. In order to identify optimisation opportunities, particular focus is placed on examining the following aspects:

- Tax determination logic

- Parameters relevant for tax determination

- Correctness of invoice forms

- Partner functions

- Customer-specific customising

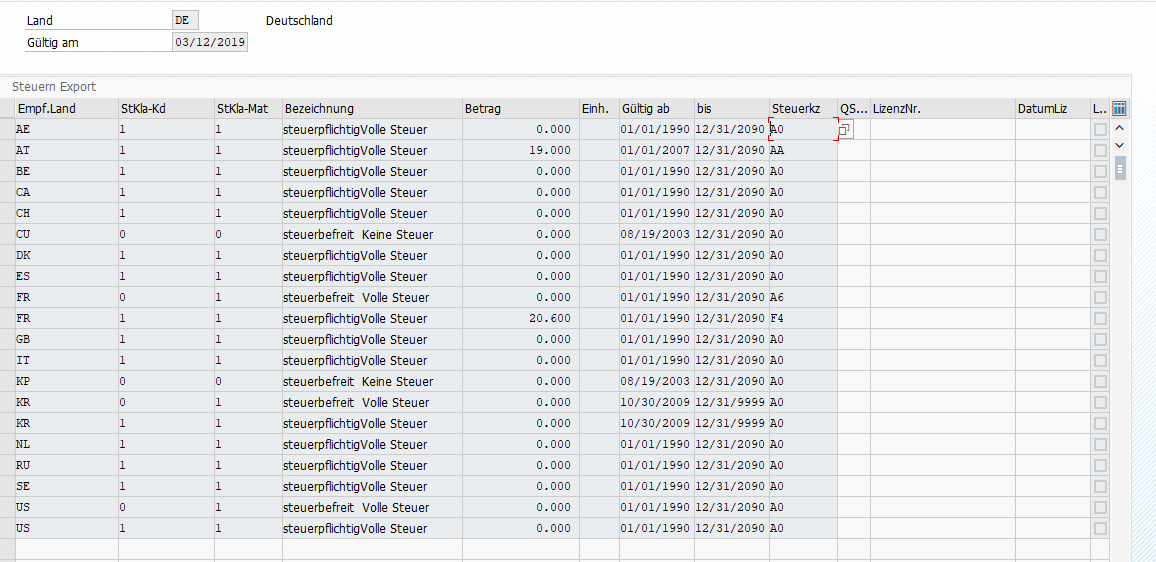

Selecting and customising of a tax engine

Although modern ERP systems already offer an extremely wide range of functionality, there are situations in which companies suddenly find themselves in need of previously unanticipated functions. This is where so-called tax engines come into play.

A tax engine is an external solution for tax determination. It replaces the condition technique of the existing ERP system. The information relevant for taxation in the ERP system is transferred via interfaces to the tax engine which determines the correct taxation and transfers the results back to the ERP system.

The use of tax engines makes it possible to combine newer technologies with the existing ERP system. This allows the functional scope of the reporting and user interface to be expanded without experiencing any problems. For example, Java applications for web browsers can be created, which significantly simplify the handling of the SAP system.

Tax engines are usually delivered as standardised software. Extensive customizing is therefore required to integrate the tax engine into the existing system. Tax engines must be implemented into your existing ERP system within the scope of customising projects. We can support you in both selecting a suitable tax engine and in adapting it to your tax determination.