VAT is a mass business, and companies often choose fully automated ERP systems to handle their transactions. However, if any failures in the automation process occur, irrespective of how small they might be, the incorrectly calculated sums will multiply at lightning speed. Usually, this leads to high additional VAT claims and the accrual of interest on additional payments. The processing and correction of transactions from the past is also usually very time-consuming and cost-intensive.

Be on the safe side and avoid this problem by simply involving us, as consulting experts, at an early stage. We can act as an interface between your IT department and your company’s individual business units, e.g. logistics and sales, as well as with your tax department, in order to ensure the operation of legally watertight procedures. To this end, we conduct VAT audits. For us, this does not merely involve a review of the documentary evidence pertaining to individual business transactions but rather a structural and functional examination of the ERP system.

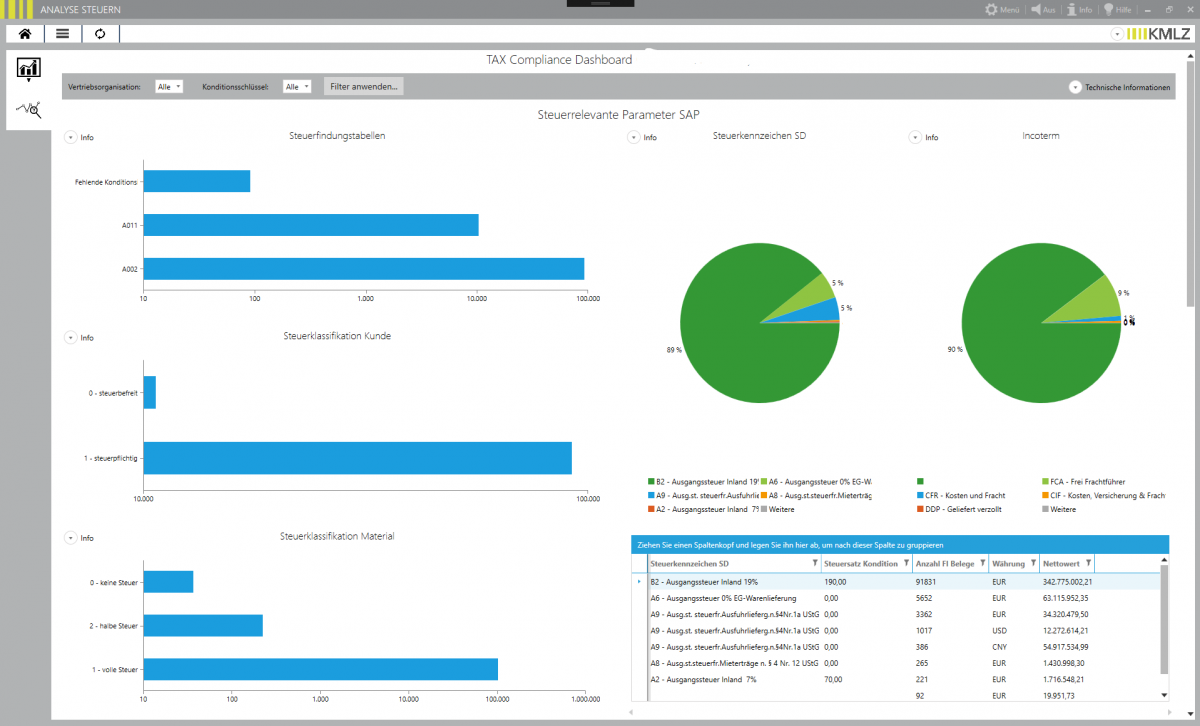

For the purpose of getting to the bottom of the matter and being able to evaluate the data in your ERP system in detail, we have developed our own Data-Mining-Dashboard, which can be used on a wide variety of BI platforms. This dashboard allows us to check which errors in the system’s basic settings have materialised. It also helps us to identify business transactions in your system that could pose VAT risks.

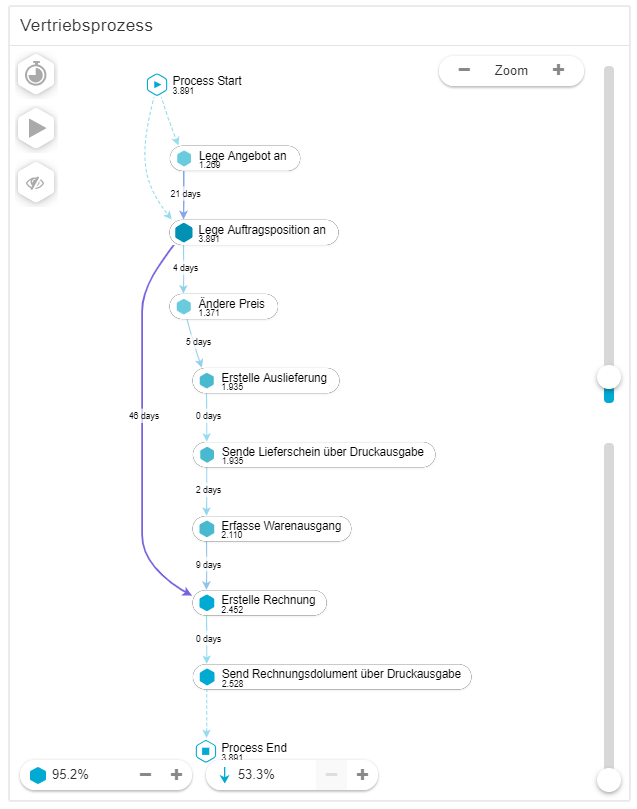

If we identify any critical business areas or transactions, we can analyse the underlying processes on the basis of their digital traces within the ERP system and reconstruct them. In doing so, we not only evaluate the financial accounting data, but also access all sectors of the ERP system. This enables us, for example, to describe sales processes in fine detail, from order acceptance to the dispatch of goods and invoicing.

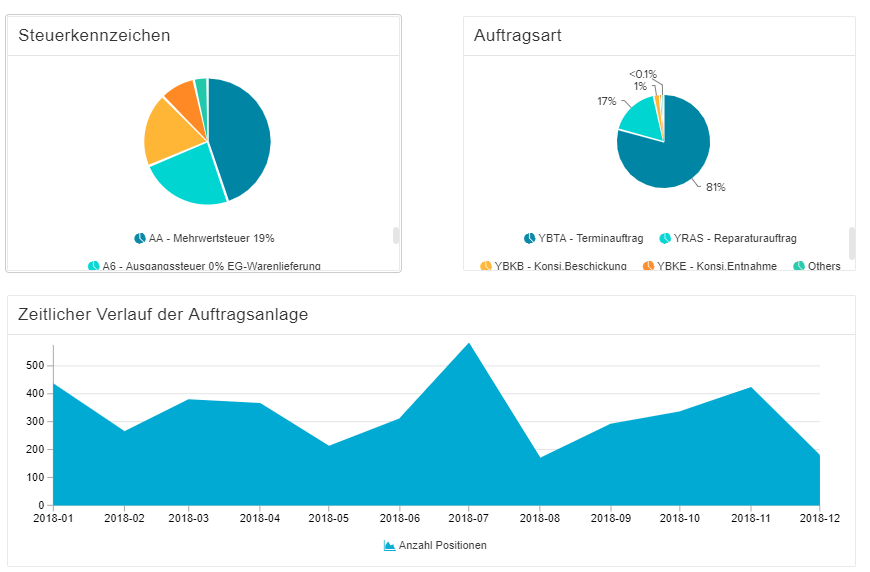

Using various process mining solutions, we are able to extract and visualise the process information contained in the ERP data. In this way, valuable, previously hidden internal company know-how can be gained and presented in a comprehensible way. Process mining is therefore a perfect supplement to the findings from the Data-Mining-Dashboard.

Through the application of our solutions, we not only bring to light tax-relevant anomalies in your business processes, but also identify exactly the point in the workflow where the anomaly arose. In this way, errors can be eliminated in a targeted manner and processes can be optimised efficiently. All we need is a data extract from your ERP system. We evaluate this extract and provide you with a comprehensive representation of your internal processes.